[vc_row][vc_column][vc_column_text]

Blockchain is one of the most promising new technologies of the future.

Blockchain has been around for quite some time now, but the markets only became aware of this technology because of the “bitcoin madness” let’s call it.

Blockchain is the technology that, until this day, is mostly used to facilitate the creation and movement of cryptocurrency from one individual to another.

In this article we will approach the matter theoretically and refrain from making references to the actual technical parts. We will try to explain the concept that is blockchain by approaching the subject only from the view of financial transactions.

Without Blockchain

In order to make a transaction in an environment other than blockchain you most likely have to go through a third party that both you and your counterparty trust. Don’t think about it from the perspective of technology: black screens and white signs only programmers with black T-shirts can read.

Let’s say you want to transfer a sum of money; to do so you have to order a third party to make the transfer for you. That third party will most likely be a bank, since till this day in the West very few people can envision a world where not banks but other entities will be holding their money. In Asia, on the other hand, Alipay and WeChat have a huge chunk of the market of money in their role as the third party in most everyday financial transactions.

In any case, entities (banks or other) that hold money for or receive money from persons are selling the service of transferring money. To be more precise after these entities confirm that the sender of the payment has available funds they identify the receiver of the payment and deposit the money in its account, while withdrawing the same sum from your account. But of course, this service costs. At the same time, depending on the specific banks involved in the process and the countries they reside in, this transfer can take a few days to go through.

So now we have two problems, both resulting from the involvement of the third party/intermediary: (i) there is a fee owed to that third party and (ii) it takes time for the transfer to actually go through.

This is where blockchain comes in.

The innovation of blockchain

Blockchain resembles a database. Of course that, on its own, is not revolutionary. The innovation is that, while databases have traditionally been centralized, blockchain is decentralized. This means that there has until now always been a need of a “central authority” (a third party, as described above) recording and verifying data transactions happening on those databases. This is not the case with blockchain.

The need for third parties to intermediate transactions has until now seemed like the only way: parties who wish to transact cannot blindly trust each other. Thus, a need for verification/insurance from a prestigious third party emerged.

But what if the transaction had no risk at all? What if the verification of data was automatic? What if there was a way to ensure that even if the slightest of the data represented by one of the parties did not check out, the transaction would be automatically blocked and no risk regarding what was communicated would be assumed?

What blockchain does is exactly that.

The Mechanics

As promised, a visualization of blockchain technology:

(a) Blocks

Each block contains a single piece of information, in the form of a code. That code gives a specific ID to each block. To better understand it, let’s say that code is a letter of the alphabet. In this case, one block would contain the letter A.

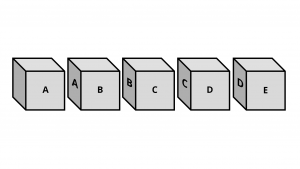

(b) Chain (chainm of transactions)

Blockchain consists of a series of blocks, each one containing a single piece of information on the “inside”, and ID and the “IDs” of the blocks that come before and after them on the sides “touching them”, like so:

This “function” makes sure that no one can hack the code contained in blocks, because if you hack one block (which would on its own take a ridiculous amount of time), the ID of that block would change (since the IDs of blocks depend on and adjust to the code in the block). So if you hacked Block B, it would no longer be called B. But Block C would still witness that block B should come before it. Now if you hacked block in order for it to witness that not Block B, but the block with the new ID (taken after block B was hacked) was the one that came right before it, then the name of block C would change and so on…

This “function” makes sure that no one can hack the code contained in blocks, because if you hack one block (which would on its own take a ridiculous amount of time), the ID of that block would change (since the IDs of blocks depend on and adjust to the code in the block). So if you hacked Block B, it would no longer be called B. But Block C would still witness that block B should come before it. Now if you hacked block in order for it to witness that not Block B, but the block with the new ID (taken after block B was hacked) was the one that came right before it, then the name of block C would change and so on…

For a blockchain to function (for a transaction to be valid, as we will see below), the chain has to at any point verify itself.

One might say that you could try and hack all the blocks in the chain and all the copies of the chain (see below), but, with blockchain technology being as strong as it is today, there is not enough time and computational power in the world to do so.

(c) Introducing a different way to record transactions.

Those chains of blocks are much like a ledger in accounting. They record all transactions, all debits and credits. A simplified example would have as follows:

- X has 10 (Block A)

- Y has 2 (Block B)

- X gives 10 to Y (Block C)

- X has 0 (Block D)

- Y has 12 (Block E)

A blockchain can simultaneously tell us how much (money) there is and where it is (who has how much). So it truly does not matter what is represented by any party that wishes to transact. We do not have to trust anyone regarding the truthfulness of any representations -not someone we know or don’t, not a third party. We do not even have to trust blockchain. Anything recorded in a blockchain is a fact.

Any transaction not verified by blockchain is not valid. Anything not validated do not actually happen (technology will not allow an invalid order for a transaction to create and add a new block in the blockchain). Those safeguards result in creating the safest, till this day, environment to transact in.

In our example, if X tried to give 20 to Y instead of 10 in step one above, blockchain would not allow the transaction to go through, simply because X does not have 20 to give.

But how can blockchain know? Well … it does not exactly know. But thanks to the principles following, all persons in the network do know and their knowledge alone ensures that the blockchain is valid and protected, through a distributed and decentralized system, which up until this day seems unhackable.

The principles behind blockchain

All the essence of blockchain, what renders it the most secure environment to transact in, is its principles:

(a) Open Ledger Principle

Everyone in the environment of blockchain, under circumstances, can see all the data (open and public information), but they cannot actually make up the information, because they can only have bits and pieces of it. Thus, everything is public and private at the same time!

(b) Distributed Ledger Principle

The open ledger principle on its own would not go far without the distributed ledger principle. The latter ensures that anyone who wishes can hold a copy of the ledger (chain of blocks).

(c) Shared Ledger Principle

When you wish to make a transfer through blockchain, you have to make that intention of yours public. The network will immediately see the declaration of your intention. At this point, the transaction is still unvalidated, and thus not yet part of the blockchain – it has not yet created a new entry in the ledger, a new block, so it has not yet taken place. Blocks are created and added to the blockchain only through mining.

All the above principles can only reassure anyone who chooses to transact using blockchain. Just imagine how much easier it would be to hack a central authority (eg a bank), than the thousands that may have a copy of the ledger (hack all the blocks of the blockchain and all the copies of the blockchain held by all the peers).

Mining

Anyone can mine. Miners are persons that choose to hold a copy of the ledger. What they do is compete amongst each other (amongst those who hold a copy of the same chain) in order to be the first to validate a transaction and put it in the ledger (make a new entry – add a new block).

Mining comes in two steps:

- Validation: miners essentially check that a transaction is valid according to the data already validated and in blocks.

- Connecting that new block to the chain: to connect a new block miners have to “find a key” that will mathematically allow them to add that new block. Imagine it like solving an extremely complicated riddle by using computational power.

The first to validate a transaction and add a block to the blockchain gets a financial reward.

Application of blockchain

The very concept behind blockchain technology is unconceivably groundbreaking. Theoretically, if applied, it will eliminate the need for any middle man, including banks, even governments, while simultaneously ensuring that transactions are as secure as can be!

Many governments have felt uncomfortable with all those changes happening. Some more than others: China has “banned” the trading of bitcoin altogether.

With bitcoin having almost reached USD 20.000 per bitcoin at its peak, billions of dollars have exchanged hands without anyone having any record of those transactions, without any banks having gotten any fees, without governments having any control over the exchange rates in order to protect their currencies. And all that happened because just one application of blockchain became popular!

Recently, the World Bank launched a new debt instrument (bond-i) that is blockchain operated. In Cyprus big law firms accept payment in bitcoin, and the relevant laws are in the making.

Blockchain is not a technology for the dark web, but a technology for all of us. Today.

To that new reality that blockchain is leading us to we all (and of course businesses and lawyers) have to adapt.

And soon!

Lida Koumentaki

Junior Associate

P.S. A shorter, Greek version of this article has been published in MAKEDONIA newspaper (November 4, 2018)