The importance and value of Business Angels (: Angels Investors or Business Angels) in the development of entrepreneurship and the economy is well known worldwide. However, as the business and investment culture differs from country to country, the supply and use of funds from Business Angels appear different, respectively. We hope that the recent, albeit small, push of the relevant institution by the State will contribute to its (desirable) development. It is worth, on the occasion of the resurgence of the relevant discussions, to take a deep dive into the institution.

Who are the Business Angels?

Business Angels are, according to the European Commission, independent individuals with business experience, who choose to invest part of their fortune in new and promising (in their opinion) private companies. They invest individually or, alternatively, as part of a consortium, where one (possibly) most usually takes the lead.

Business Angels do not only offer funds to the business. They also offer their experience, skills and contacts, in order to expand the business activity and, of course, their personal benefit.

Business Angels and startups

Business Angels play an important role in the global economy. In many countries they have a significant position as external financing sources for startups.

In fact, they are proving to be increasingly important as providers of venture capital, contributing to economic growth and technological progress.

It is well known that startups hope for and aim to the financing of Business Angels – not unjustly, as the data shows.

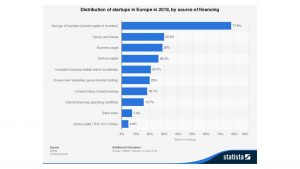

The degree of penetration of Business Angels in the financing of startups in Europe is interesting as it results from a survey conducted on behalf of EBAN (: European Business Angels Network) and concerns the year 2018. The data presented in the table below are from this survey:

Based on the data of the reference year (: 2018), almost 1/3 of the startups in Europe (more precisely: 29% of the total) utilized the financing and assistance of Business Angels. It is noteworthy that the latter (: Business Angels) fall short only of those cases in which the founders contributed the necessary funds (77.8% of the total), while a respective percentage of funding derived from investors in the category “Family and Friends” (: 30.2% of the total).

The participation of Venture Capital in the financing of startups is significantly lower (: 26.3% of the total) while bank lending is rather negligible (: 7.4% of the total).

Business Angels: how many are there?

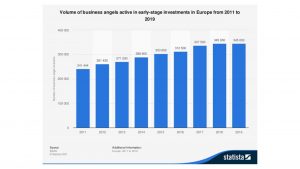

It is interesting, however, to focus on the numerically growing presence of Business Angels, over the years, in terms of the early stage of investment in Europe. Relevant research of the same Organization (EBAN) deals, among other things, with this issue. Hence the data in the table below.

From the above table we come, based on the available data, to two main conclusions: (a) that the approximately 240,000 Business Angels that were active in 2011 in Europe gradually reached 345,000 in 2018 & 2019 and (b) that their increase in numbers has been gradually halted in recent years.

Business Angels, Large, and Small and Medium Enterprises

And once we see the significant presence of Business Angels among the sources of funding for startups in Europe, it is worth taking a similar, quick look at Large and Small and Medium Enterprises (looking for them, respectively, among their sources of funding). Our source: The European Central Bank and its related research. Let’s focus on the table that lists their sources of funding:

So, although Business Angels are, as we have already seen, significantly involved in startups, their involvment in larger companies (Small and Medium and Large) is completely non-existent. This fact is logically expected: the needs of these companies are extremely high and, in any case, inversely proportional to the capabilities of the Business Angels.

The Business Angels in the USA

The investment culture that characterizes the USA is of course different from the corresponding European one – much more the corresponding one of our country.

The data from the Angel Funders Report 2020 seem very interesting:

According to the Angel Capital Association: (a) Business Angels invest approximately $ 2.5 million each year in various businesses in the United States, (b) Business Angels business and financial assistance generates the background for achieving total funding of 2 billion USD from startups, (c) the total funding of 25% of startups comes from Business Angels and (d) in 40% of the new agreements that took place in 2019, Business Angels held a position in the management of the companies with which they came to an agreement.

Business Angels in our country

From what has been mentioned above, the importance of Business Angels worldwide, in Europe, of course in our country as well, seems absolutely obvious. Efforts to create a relevant Network in our country but also to encourage investors to operate as such have already emerged, with the most important one coming from the Athens Chamber of Commerce and Industry, created by the Network of Business Angels.

However, in the context of the broader effort of the Athens Chamber of Commerce and Industry to restart the interest for the activation of Business Angels, it became the head of the Gazelle project. This project was created within the Interreg-Balkan Med Program and several countries participate (Greece, Cyprus, Bulgaria, Northern Macedonia). Its purpose: “the development and pilot implementation of a coherent framework for the design and implementation of joint sustainable measures aimed at creating, improving and accelerating the market of Business Angels in the Balkan-Mediterranean region”.

According to the assessment of the recently deceased Mr. Kon. Michalou (President of the Central Association of Chambers of Greece and the Athens Chamber of Commerce and Industry), who shared with the signatory-just before his unexpected loss: “With the activation of the recent, favourable, tax measures, regarding the investments by the Business Angels, we expect the revitalization of this institution, which will contribute to the strengthening of entrepreneurship and the economy of our country”. We look forward to confirming his prediction.

The investment culture in our country is not at all equivalent to the corresponding US and European one. The presence, therefore, of Business Angels in our country could be characterized as rather non-existent. However, their importance in the economies where they operate is obvious. In this context, it seemed necessary to provide them with incentives in our country, to attract and utilize them.

For a year now, albeit belatedly, there has been the appropriate legislation in place (: article 49 law 4712/2020) with significant tax incentives for those who would be willing to act as Investment Angels. Unfortunately, its coming into force was not quick, as a Joint Ministerial Decision was required, which was issued almost a year later.

The content of the specific provisions and, above all, the issues on which the owners of startups but also, of course, the Business Angels should focus on for their protection, will concern us in an article of ours to follow.

However, the substantial development of this institution and the assistance of its utilization is desirable for everyone, in the context of the (much desired) development.

The baton has already passed into the hands of the Business Angels.-

Stavros Koumentakis

Managing Partner

P.S. A brief version of this article has been published in MAKEDONIA Newspaper (August 22nd, 2021).

Disclaimer: the information provided in this article is not (and is not intended to) constitute legal advice. Legal advice can only be offered by a competent attorney and after the latter takes into consideration all the relevant to your case data that you will provide them with. See here for more details.