Businesses need capital (own or foreign) to survive and grow. In Europe, they turn to the banks, mainly, for their extraction. The European economy therefore is (and does not just look) bank-centered. The Greek market even more so. The comparison with the USA, the United Kingdom and Japan (: countries, that is, with developed capital markets) proves the statement to be true. It is not simply a matter of theoretical findings: the relative magnitudes leave no room for misinterpretation. Should we take it for granted that European companies’ fundraising will start to shift outside the banking system – to the capital markets, for example? And, if so, will this also apply to Greek companies? And if so, when?

For the advantages (of course conditions and disadvantages) of financing outside the banking system (capital markets and beyond) we will be given the opportunity to deal with in our next article. Respectively with the conditions for increasing the creditworthiness of companies. Let us now try to give an answer to the questions mentioned in the introduction.

Capital Market: US vs EU

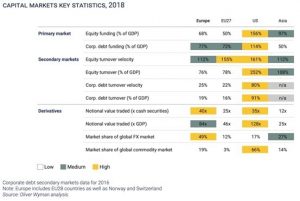

One indicator that is commonly used to assess the size of a capital market development is that derived from the market capitalization / GDP ratio.

A relatively recent report by FESE (Federation of European Stocks Exchanges) records an interesting statistic (based on the latest World Bank data published on 31 December 18). Specifically:

Let us limit ourselves to the Index: Market Capitalization / GDP. We notice that it amounts to:

At 156% for the US,

At 50% for the EU27 and

At 68% for Europe (EU27 + Great Britain + Switzerland + Norway).

Therefore: for the European Union of 27 the relevant index is limited to 1/3 of that of the USA.

A very obvious finding follows, that the European capital market lags behind that of the United States.

There is also, as self-evident, the extremely limited use of European stock exchanges to raise capital by European companies.

“The Greek economy is primarily bank-centric”

The Governor of the Bank of Greece, Mr. Stournaras, participated, among others, in an online event of IOBE on 17.12.20 entitled “Financing, private debt and restart of the economy”. His speech, due to his position, was, of course, of particular importance.

Referring to the Greek economy, Mr. Stournaras said: “The Greek economy is primarily bank-centric. What do I mean by that? Suppose one hundred units of funding are required. And let’s look at America, Europe and Greece. Of the 100 funding units in America, half, about 50%, comes from the capital markets; the other half from banks. In Europe, roughly 75% comes from banks and 25% from the capital markets. In Greece, 95% of the banks and 5% of the capital markets. So Greece is an exceptionally bank-centric country and banks play a very important role in financing and economic development.”

However: As will be shown later on, the truth is (unfortunately) worse. Corporate finance from the European capital markets holds an even smaller percentage than what our central banker supports. (We can safely assume the same for Greek companies…).

What if we look for the reason? We must, above all, attribute it to the structure and composition of the European economy. But even more so: in the general culture that prevails in the field of business finance in the old continent.

The participation of the capital market in the financing of Greek companies

Unfortunately, there does not seem to be (published-processed) data regarding the financing of Greek companies outside the banking system. But even if we accept as accurate the (rather optimistic) approach of Mr. Stournaras (: 5% share of the capital market as a whole), the conclusions still are absolutely disappointing.

Listed companies, based on data from the Hellenic Capital Market Commission, are limited to: (a) one hundred and seventy-one (171) for the Main Market and (b) eleven (11) for the Alternative Market.

Therefore: one hundred and eighty two (182) companies with listed shares in Greece (possibly those that were listed) share the 5% corresponding to the financing from the Greek capital market.

For the rest (95%) that corresponds to the financing (basically) from the banking system, the 182 mentioned above are competing with the rest of the 821,540 (!) Greek companies. (Their total number is derived from the published data of the European Commission of 2019).

EU data on SME access to capital markets

The (dual-secondary) problem of the EU

The finding of the central banker of our country (: “The Greek economy is primarily bank-centered”) identifies the problem. However, the magnitude of the dependence of the European economy and, consequently, of the Greek economy on the banking system seems more serious and worrying than he points out.

Our (safe) source, the data and the position of the European Commission, expressed in: “Unleashing the full potential of European SMEs”. From what is mentioned there, it follows that:

(a) Only 10% (!) of the external financing of European SMEs (ie from third-party sources) comes from the capital markets and

(b) Only 11% of companies in Europe consider equity as a viable financial option. Most importantly: only 1% have used it.

EU actions to manage it

In order for the EU to manage the above (double & extremely serious) problem it decided to create:

(a) A fund for the listing of SMEs on the stock exchange.

This private / public fund was established under the InvestEU program. Through this, investments will be channeled to stimulate the financing of companies as well as funds run by women.

(b) The ESCALAR initiative

This initiative aims to create a mechanism to increase the size of venture capital and attract more private investment. Its purpose: to support companies with high growth potential.

The success of both remains to be seen…

The real (: main) problem of the EU and its management

The real problem that the EU has to deal with does not seem to (only) be the creation of the conditions for better access of businesses to the capital markets.

The real (and main) problem of the EU is to limit the further expansion of the financial system in the EU. And the consequent mitigation of the risks linked to this expansion.

Most importantly: limiting the power of banks and bankers to the detriment of EU political power.

The above-mentioned EU actions are, in principle, aiming in this direction.

Do European SMEs have less money available than their US counterparts?

The Association of Financial Markets in Europe (AFME) in collaboration with the Boston Consulting Group proceeded, together – six years ago (: 2/2015) to publish an interesting report: “Bridging the growth gap Investor views on European and US capital markets and how they drive investment and economic growth”.

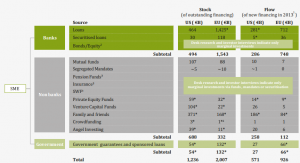

We read in this report, among other things, that more money is available in European SMEs than in the US. According to the analysis estimates, SMEs (companies with a Turnover of less than € 50 million) in Europe have almost doubled the funding (compared to the US) from banks, non-banks and governments. The data emerge as particularly interesting. Specifically:

We conclude from the above, indicatively, that in 2013 (taken into account as a reference year), 926 billion Euros of new financing, of all types, were given to European SMEs, compared to 571 billion Euros in the USA. The data, in both areas, exclude financing provided by personal financing (including funds made available to SMEs by their owners through their personal wealth and retained earnings).

Based on the same analysis above: surveys and interviews show that European SMEs strongly prefer bank lending over personal or alternative sources of financing. This, moreover, is evidenced by the evolved character of the latter (such as venture capital and angel investing-available in smaller SMEs in Europe.

In 2013, for example, €26 billion was invested by venture capital companies in SMEs in the US – compared to just €5 billion in their European counterparts. During the same period, €20 billion was invested by angel investors in US SMEs – compared to just €6 billion in Europe.

Therefore: there is no shortage of money flowing into European companies. The problem is that companies are looking to recieve them (primarily) from banks. In this way, however, the banks become “dominant in the game”. Not only does this not solve the existing problems but, on the contrary, it multiplies them.

Problem…

It is a common finding that the rapid growth of the (global and European) banking system poses serious risks to the economy. It has already been proven that these risks are not theoretical. Both in the US and in Europe-recently and in the context of the (long-European) financial crisis. National economies have reached the brink of collapse due to the rapid growth and weak foundations of the banking system (see, for example, Cyprus and, secondarily, Greece).

Also: the attitude of the banking system towards the SMEs in Europe and our country has been diagnosed as a serious problem. And so has it been again, in the context of the ongoing health / financial crisis.

… vs business opportunity

Should the specific problems mentioned above maybe push us in thinking “out of the box”? Do they force us to treat (and manage) them as an opportunity? An opportunity for gradual disengagement of the SMEs (but also of the national economy) from the entanglements and risks of the banking system?

Is it time for SMEs in our country (as well) to turn to financing outside of it (the banking system)?

To take advantage of the (given-alternative) funding opportunities out there? (Which will always increase ..)

(And) of the Greek capital market?

There is no doubt!

The time has come (as will be shown in an article of ours to follow).

Stavros Koumentakis

Managing Partner

P.S. A brief version of this article has been published in MAKEDONIA Newspaper (March 28, 2021).

Disclaimer: the information provided in this article is not (and is not intended to) constitute legal advice. Legal advice can only be offered by a competent attorney and after the latter takes into consideration all the relevant to your case data that you will provide them with. See here for more details.