It is common ground that Small and Medium Enterprises (: SMEs) need support for their survival and development – especially in the current circumstances. First and foremost, hey need funding. We have already seen that our European and national economies are, without a doubt, bank-centric. And this is something that needs to change, for many reasons. Banks neither can and nor do they want (nor is it appropriate) to bear the burden of financing the companies that need them. Both the economy and SMEs, in particular, have an (insurmountable) need to activate and leverage more, different, sources of funding. Undoubtedly, one of them is the capital markets – the stock exchange. EU data show that only 10% (!) of the external financing of European SMEs (ie from third-party sources) comes from the capital markets. The EU, albeit at a slow pace, is already working to assist SMEs in their first steps.

Let’s take a look at the current processes taking place at European level to assist SMEs in their first steps in the magical (?) world of capital markets.

EU assumptions about SMEs

“There are 24 million SMEs in the EU-27. They represent the backbone of the economy. They generate more than half of the EU’s GDP while at the same time employing more than 100m. employees before the onset of the pandemic”. “On this basis, and in the light of the Covid crisis, we must take for granted the need to revise the SME Strategy” which was decided on 10.3.20 – just one day before the World Health Organization sounded the alarm on the pandemic of Covid-19 “(: Press release of 13.11.20 of the European Parliament).

The specific assumptions, from the most official sources, cannot be disputed. In fact, the data they contain make it necessary for all of us to become alert. But above all the EU. Of course, our national government as well.

The ” road to Calvary” of the stock exchanges

The course of public offerings in the European Capital Markets

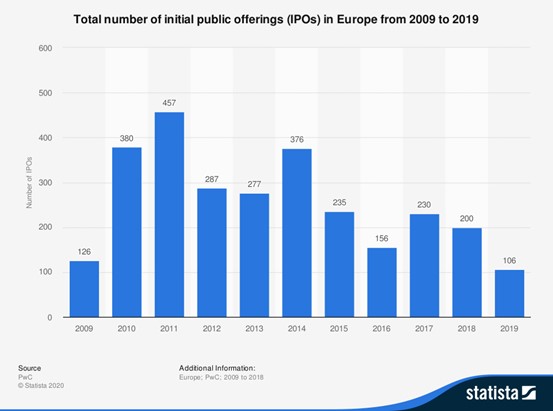

Let’s take a look at the initial public offerings of the last decade (2009-2019) in Europe:

It would not be possible to characterize their course (of the initial public offerings) during the last decade as blooming. However, this also reflects the interest of companies to list their shares in regulated markets. Respectively of investors for the capital markets.

The course of the Greek stock exchange market during the last 20 years

The boom (but also) frenzy of the Greek stock exchange market, which had the well-known (technically and logically expected) collapse of 1999, was followed by its contraction of the next twenty years.

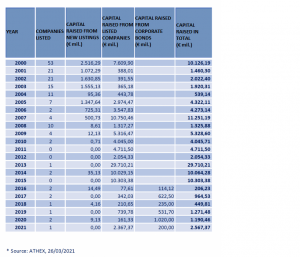

Let’s also take a brief look at the extremely interesting data of the Athens Stock Exchange, from 1.1.2000-to 26.3.21 (which it kindly provided to us and with its permission we make public):

The well-known efforts of the Athens Stock Exchange, as we all know, are proving to be bearing fruit in recent years in the corporate bond market. Of course, the largest companies are currently benefiting from it.

And the stock exchange market?

Let’s take a look at the (problematic) three years 2013-2015: €50 billion were raised. Also: in the first quarter of 2021 more than €2.3 billion was raised. Although the issue may seem multifactorial, it turns out that the stock exchange market can help raise funds. SMEs are, of course, entitled to their share. And, of course, to the relevant assistance.

The EU is already moving in this direction…

EU: The creation of a fund to assist SMEs during and after their listing

The (basic-initial) assumptions about the necessity of creating such a fund

One year ago (: 10.3.20) the European Commission published a Communication to the European Parliament and other EU institutions entitled “SME Strategy for a Sustainable and Digital Europe“.

In the above (extremely interesting) Announcement, important assumptions are made. Among them:

“SMEs in Europe find limited possibilities for growth financing, such as listing on capital markets through an Initial Public Offering (IPO). Capital markets are an important source of funding for SMEs growing int mid-caps and ultimately large companies. However, the number of SME IPOs declined sharply in the aftermath of the financial crisis and has not recovered since. In 2019, the value and number of European IPOs continued to fall by 40% and 47%, respectively, relative to 2018.”

In order to address this problem, it is accepted by the European Commission that it would be particularly useful to set up a fund to facilitate the listing of SMEs during and after the registration process. In this way, more fast-growing and innovative SMEs would turn to the capital markets to raise the necessary funds for their development. More private investors would be attracted to the capital markets. The economy (European and, why not, national) would end up less “bank-centric”. Such a choice could only have positive results.

In this context, the European Commission undertook, inter alia, to “support Initial Public Offerings (IPOs) of SMEs with investments channelled through a new private-public fund, to be developed under the InvestEU programme starting 2021 under the Capital Markets Union”.

Motion for a resolution of the European Parliament

Last September (: 16.9.20) a motion for a European Parliament resolution was tabled on further development of the Capital Markets Union (CMU): improving access to capital market finance, in particular by SMEs, and further enabling retail investor participation.

This proposal records (recital 9) the “decline in Initial Public Offering (IPO) markets in the EU, reflecting their limited attractiveness for, in particular, smaller companies”. This phenomenon is due, among other things, to the fact that, according to the proposal, “SMEs face disproportionate administrative burdens and compliance costs associated with listing requirements”. It stressed “that the efficiency and stability of the financial markets should be improved and that the listing of companies should be facilitated”. Also, it noted that there is a need “to ensure an attractive environment pre-IPO and post-IPO environment for SMEs”. It encourages, in this context, “the creation and prioritization of a large, private pan-European fund, an IPO Fund, to support SME financing”.

Opinion of the European Economic and Social Committee

On 11.12.20 the European Economic and Social Committee (EESC) issued an Opinion on the above-mentioned Opinion from the Commission to the European Parliament. The EESC therefore (paragraph 5.4) “welcomes the development of a private-public fund focused on initial public offerings (IPOs) and fully supports the creation of additional equity, quazi-equity, venture-capital and risk-sharing financing instruments for SMEs”. In the same context it stated it “believes that promoting them and ensuring their accessibility is particularly important for innovative small and mid-caps”.

The course / the (temporary?) quagmire for the creation of the fund

It is known, however, that the EU does not always act extremely fast. We note, therefore, that there are other concerns about the rapid development of the whole issue: In the context of the parliamentary scrutiny, a relevant Parliamentary Question was submitted on 7.1.21 stressing the Commission’s lack of commitment to take substantive action in creating the aforementioned fund.

References under the InvestEU program

Regulation (EU) 2021/523 establishing the InvestEu program was adopted very recently (on 24.3.21).

We read, inter alia (recital 21): “SMEs represent over 99% of companies in the Union and their economic value is significant and crucial. However, they face difficulties when accessing finance because of their perceived high risk and lack of sufficient collateral… SMEs have been particularly badly hit by the COVID-19 crisis… Moreover,, SMEs and social economy enterprises have access to a more limited set of financing sources than larger enterprises… The difficulty in accessing finance is even greater for SMEs whose activities focus on intangible assets. SMEs in the Union rely heavily on banks and on debt financing… Supporting SMEs that face the above challenges by making it easier for them to gain access to finance and by providing more diversified sources of funding is necessary to increase the ability of SMEs to finance their creation, growth, innovation and sustainable development, ensure their competitiveness and withstand economic shocks to make the economy and the financial system more resilient during economic downturns and to maintain SME’s ability to create jobs and social well-being. This Regulation … should also maximize the firepower of public / private fund vehicles, such as the SME IPO (Initial Public Offering) Fund, seeking to support SMEs through channelling more private and public equity” especially to companies of strategic importance.

Is the stock exchange market the right means of raising capital for businesses?

For some it proves valuable; for others less; for others it is completely unsuitable. In fact, in our next article we will try to approach some parameters of the relevant question. It should be noted, however, in quotation marks, that the world of the stock market has not proved to be magical for everyone: neither for investors nor for companies.

However, those companies (especially SMEs) for which it would be evaluated as the, relevant, best tool available, it should be provided with the appropriate information and, of course, the appropriate assistance. In the context of the latter, in particular, the fund is expected to play an important role, which, as mentioned above, has been planned for a long time by the EU. Corresponding actions are being launched by the ATHEX and the Greek State (which we will also deal with in our next article).

We hope they do not delay.

For the good of businesses.

For the good of the capital markets.

For the good of our national economy (as well) …

For the good, in the end, of all of us.

Stavros Koumentakis

Managing Partner

P.S. A brief version of this article has been published in MAKEDONIA Newspaper (April 25, 2021).

Disclaimer: the information provided in this article is not (and is not intended to) constitute legal advice. Legal advice can only be offered by a competent attorney and after the latter takes into consideration all the relevant to your case data that you will provide them with. See here for more details.