Family businesses are the first form of business in the history of mankind. They are also the vast majority of companies in Greece, Europe and the world. This assumption is an indisputable fact. The quantitative data document it in an emphatic way. Family businesses are often associated with small and medium-sized businesses. Well-known, global, business giants are family businesses. It is for these reasons that the value of family businesses is considered (and is) absolutely crucial to the global economy. Of course to the domestic economy as well. The (special) issues they are called upon to manage are many and complex. Their problems respectively. They do not, however, receive due attention or special care at the legislative level.

Are there solutions?

But what is a family business?

The opinion (2016 / C 013/03) (: Own-initiative Opinion) of the European Economic and Social Committee on “Family businesses in Europe as a source of renewed growth and better jobs “ was published on 15.1.2016 in the Official Journal of the European Union. In it, a recommendation is made for the adoption of a definition of family businesses.

Therefore, a family business (according to this report) should be defined as one where the majority (direct or indirect) of the decision-making rights belongs to the natural person (or persons) who founded the business or is the owner of its share capital or to their spouse, parents, children or direct heirs of their children and, at the same time, a representative of the family or relatives formally participates in the management or administration of the business.

What about listed companies?

Listed companies should be (based on the same report) characterized as family businesses, if the person who established or acquired the company or their family or descendants hold 25% (and more) of the decision-making rights.

However, it was assessed by the same Opinion that this definition is too broad. It was even added that “it should be limited in a way that emphasizes the family character of the business, and especially the multigenerational purposes of its objectives”. It did not, however, come up with a (limited in scope) definition of it.

If one studies the global family business literature, they will find that definitions of the nature of “they cannot be limited” have been proposed. It is therefore a given that we have not agreed on a commonly accepted definition.

Family businesses, however, are a reality.

An indisputable reality.

And, in fact, globally.

The Importance of Family Business in the US Economy

In the US, according to research published in Family Business Magazine:

(a) 60% of businesses are controlled by families

(b) family businesses generate 64% of US GDP and employ 62% of the workforce there; and,

(c) 37% of the top Fortune-500 companies are family controlled.

The importance of family businesses in the European economy

The importance of family businesses in the European economy also seems shocking. The above-mentioned Opinion refers, inter alia, to the elements of the final report (11/2009) of the Expert Group “Overview of Family – Business – Relevant Issues: research, networks, policy measures and existing studies”. The latter shows that family businesses at European Union level – for all countries where data are available:

(a) account for more than 60% to 90% of all European companies;

(b) employ from 40% to 50% of all employees.

(c) contribute about to 2/3 of the GDP

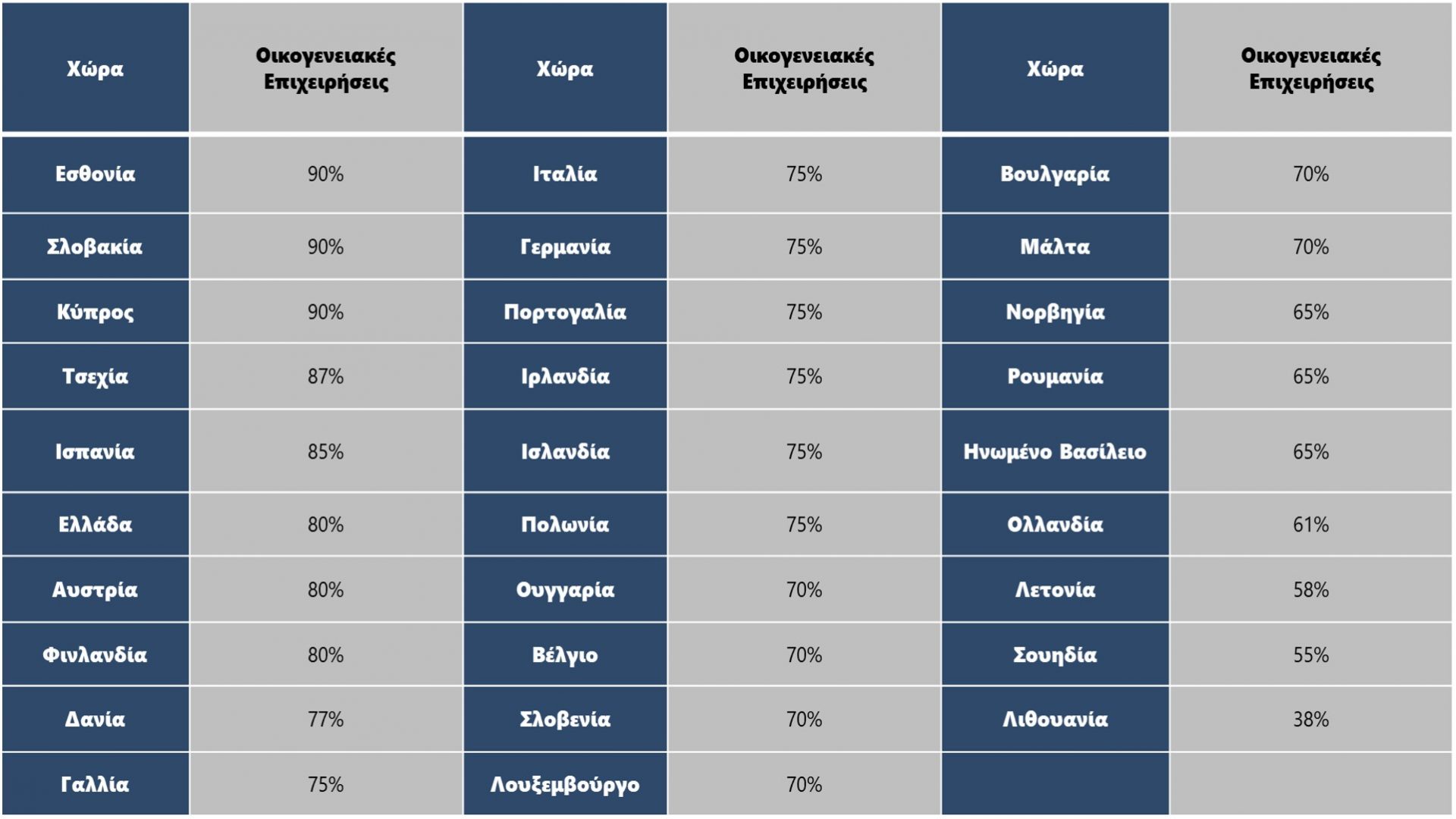

The European Union (seems to) pays special attention to family businesses. In the framework of its interest, it founded, in 1997, the European Family Businesses which is one of its organizations. Its aim is to “promote the development and continuity of family businesses in Europe, through a European program based on freedom, common values, the rule of law, prosperity and social justice”. Based on data from this Organization, the most recent data (: 2009) by European country (family businesses as a whole) are as follows:

The importance of family businesses in the Greek economy

Three years ago, an extremely interesting report was published, entitled “An Overview of the Environment for Family Businesses in Greece”. Coordinator: the Athens Chamber of Commerce and Industry (ACCI). This report was implemented in the framework of the FABUSS (Family Business Successful Succession) program – (: project in the framework of the ERASMUS program, which sought to help young people connected with family businesses, to become competent and effective “successors”).

Based on the data of this report, 80% of business owners in Greece describe their business as family run. In other words: 80% of Greek companies are characterized as family businesses by their own owners. The percentage is impressive.

Family businesses and the Greek stock market

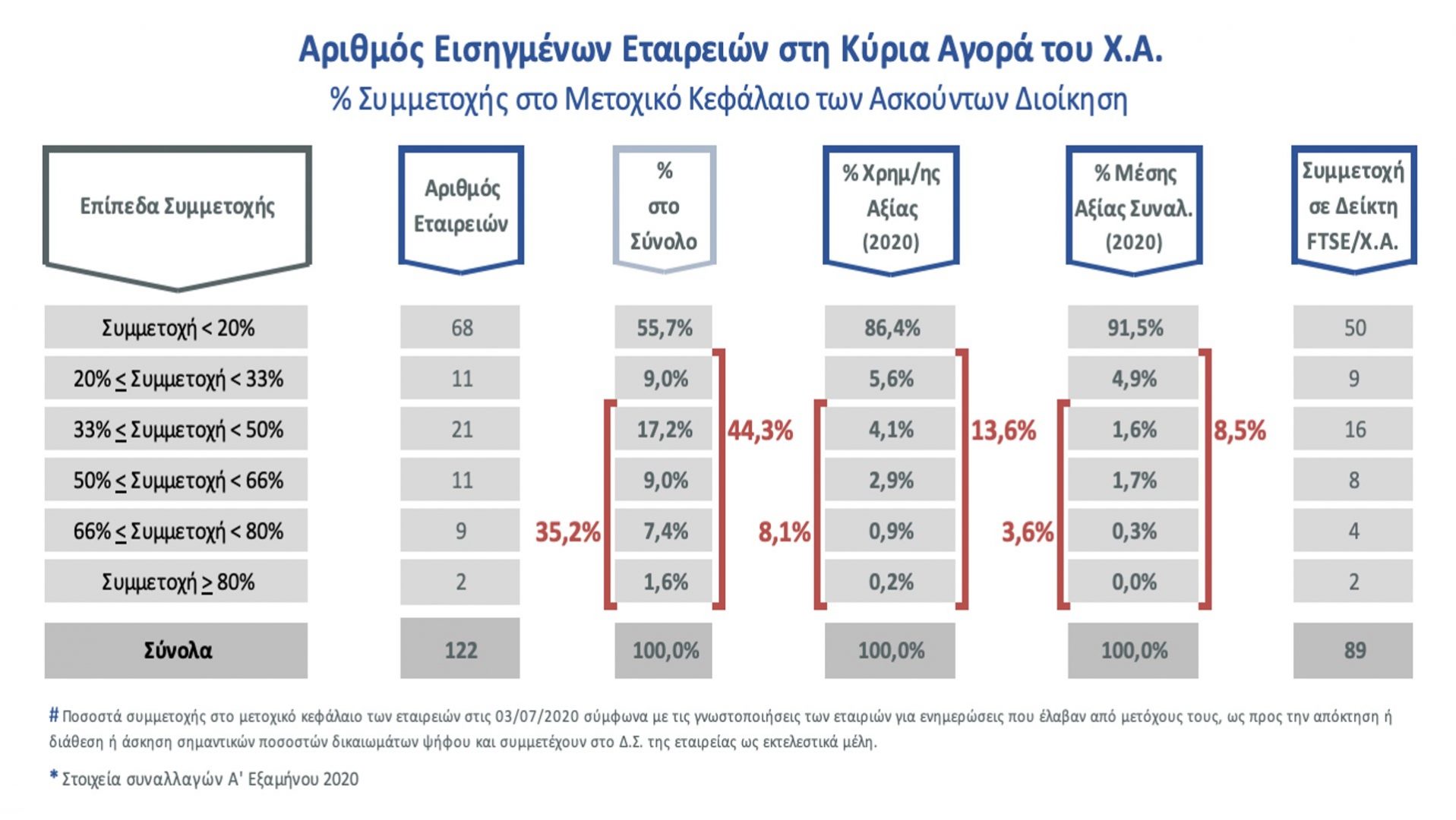

The Athens Stock Exchange is well aware of the value and importance of family businesses. In the context of the relevant understanding and care, it kindly provided us with part of the data it collects from the notifications of significant changes in voting rights, according to Law 3556/2007. Let’s take a look at one of the relevant tables:

In family businesses, the management is exercised, basically, by the holders of significant percentages of their share capital. This is a safe rule for spotting the family nature of a business. [above mentioned, No. 2016 / C 013/03 Opinion (: Own-initiative Opinion) of the European Economic and Social Committee].

From this table (and the detailed data that accompany it) extremely interesting conclusions are drawn for the companies listed on the Main Market of the Athens Stock Exchange. One of them, which is a quite safe conclusion to draw in fact, is that among them, family companies exceed the rest listed companies by 44%.

From the other conclusions we choose to mention the ones that are most interesting in the context of the present. Among them:

(a) In 44.3% of the listed companies on the ATHEX Main Market, the executives hold more than 20% of their share capital (: most likely members of one or more families). Respectively: in 35.2% of the same companies, the executives hold more than 1/3 of their share capital and

(b) 13.6% of the market value of those listed on the ATHEX Main Market are from listed companies in which the executives hold more than 20% of their share capital. Also: 8.1% of the market value of the same companies are listed companies, in which the executives hold more than 1/3 of their share capital.

Based on the data that, by law, the companies listed on the Main Market of the Athens Stock Exchange must provide, we can safely spot the family companies. It turns out that their participation in the stock market, their business and financial development is not negligible at all.

In other words: Family businesses also have a significant role in the Greek Stock Exchange.

The issues that concern a family business – especially the issue of succession

We could safely conclude, based on the above, that family businesses are the musculoskeletal system of the Greek economy. They do not, however, enjoy any particular privilege. They do not enjoy (nor have they ever enjoyed) special attention from the executive authority. Most interestingly: Not even from the researchers. Other categories of business (which include, unquestionably, family businesses) seem (?) more interesting…

Extremely important data emerge from the above-mentioned ACCI report. Among them: the problems faced by family businesses. The most important of these (seems to be): the issue of succession.

Seven out of ten family business owners plan to pass on the family business to the next generation. But this is not, of course, an automatic or, at least, simple process.

According to the same report, the most important problems regarding the succession concern the high transfer taxes, the need to adapt the business’s staff to the new ownership and management regime, the insufficiently developed administrative capacities of the successors and their low level of training.

The most important factor for successful succession (seemingly) is the change of mentality of the founder / director. Such a change concerns a multitude of modules. From seemingly simple issues (moving away from everyday business and making strategic decisions) to more complex ones (assisting the successor in managing and handling the next day).

The development of a succession management plan is undoubtedly absolutely necessary. And so is the assistance of appropriate counselors.

Our country is not characterized by a lack of consultants (business, tax, legal).

We all know a plethora of such.

The (self)projected as experts on succession issues, infinitely many.

The really capable, however, are very few.

The advantages of family businesses

The most important advantages of family businesses (also as per the the above-mentioned Opinion) could, as a rule/indicatively, include the following:

(a) The long-term perspective of the activities of the family businesses and the specific values that govern them.

(b) Building inter-business relationships on the basis of trust. [As the family business is characterized by the intention to pass it on to the next generation, it treats (basically) its employees with care and responsibility. They are, after all, the ones who will support the next generation (as well). This element further strengthens the relationship of trust].

(c) The high quality of the products or services offered. Creating long-term bonds with employees, customers, suppliers and local communities.

(d) The investment of sufficient capital and (reinvestment) of a significant part of the profits. The effort is focused on building a stable, independent and innovative business. A key concern is to reduce business risks and pass on a healthy business to future generations.

(d) The development of family businesses in a more balanced way, in order to achieve their long-term (multi-generational) goals.

(e) The development and operation of family businesses on the basis of a system of values,

(f) The sense of personal responsibility, devotion and, possibly, self-sacrifice of those family members who either manage it and / or work within it

(g) The effort to preserve the image of the business.

(h) The (self-evident) respect for those who set up the business and take over its management.

(i) The ability to better manage crisis situations as well as periods of recession and stagnation.

(j) The sense of personal responsibility of those who exercise management and the effort to ensure the longevity of the business.

Therefore: Family businesses are characterized by a multitude of advantages over the other types of businesses.

It is worth realizing their value, nurture and further utilize them.

The recommendations of the European Economic and Social Committee

The European Economic and Social Committee in the above-mentioned Opinion:

(a) Recognizes the unique value of family businesses (according to the Small Business Act which states that “the EU and Member States should create an environment within which entrepreneurs and family businesses can thrive and entrepreneurship is rewarded”)

(b) Calls on the European Commission, on the one hand, to adopt an active strategy promoting best practice for family businesses in the Member States and, on the other, to take action to establish a legal framework and regulations for family businesses.

(c) Calls, inter alia, on the European Commission:

- To include a family business category in European statistics (Eurostat) to effectively collect family business data from national statistical offices.

- To improve the legislation on the transfer of family businesses from one generation to the next, especially from a tax point of view, in order to reduce the exposure of these businesses to liquidity problems.

- To promote the climate of family organization, which is based primarily on long-term employment.

- To assist in promoting innovation among family businesses.

- To assist in the development of education and the promotion of research in the field of family entrepreneurship.

- To support family holdings and the redevelopment of cooperative entrepreneurship, especially the type that attracts family businesses.

- Introduce tax reliefs for reinvested earnings.

The European Economic and Social Committee is an advisory body. The European Commission consults it, but it is up to the latter to decide whether or not to adopt its proposals. Unfortunately, no further legislative action has been taken on the measures proposed by the EESC.

The importance of family businesses in the international, European and national economy is undeniable. Commonly accepted (by all).

The European Union has shown its practical interest in family businesses. It has not, however, taken the next, absolutely necessary, institutional steps (eg issuing Instructions, Regulations, etc.) to assist them.

Do we have to wait for that (European Union) initiative before we act?

Obviously not.

The State must take the necessary measures in order to support 80% of all Greek businesses. Among those measures must be the introduction of tax reliefs (for the transfer of said businesses from one generation to another) and, respectively, for the (reinvestment) of profits.

Respectively, however: Entrepreneurs who (sooner or later) will be called upon to hand over the reins of their business should not hesitate and take their time, looking for excuses (for themselves). The initiation of the appropriate procedure, with the assistance of the competent persons, should not be delayed at all. Thoughts of the type: “It does not concern me.-“, “I have / we have time…”, “no one will do better!” look only natural. But not justified.

Therefore: The State must do the right thing.

Entrepreneurs must do so, respectively.

Immediately.-

Stavros Koumentakis

Managing Partner

P.S. A brief version of this article has been published in MAKEDONIA Newspaper (September 20, 2020).

Disclaimer: the information provided in this article is not (and is not intended to) constitute legal advice. Legal advice can only be offered by a competent attorney and after the latter takes into consideration all the relevant to your case data that you will provide them with. See here for more details.